2023 Tax Deduction Cheat Sheet (Plus Key Tax Workarounds)

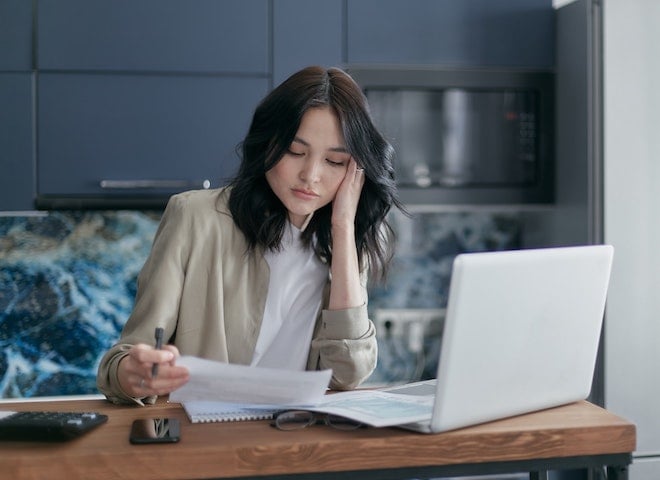

Not only can preparing taxes for your startup or LLC can be complicated, but it can also be costly. You could be overlooking thousands of dollars in deductions a year if you file without assistance....