You have set up your online store, hurray! It takes a lot of perseverance to reach this stage. Running an ecommerce business involves an ever-growing to-do list, doesn’t it? But let’s be honest, some of these items are mundane and time-consuming, yet extremely crucial — like bookkeeping.

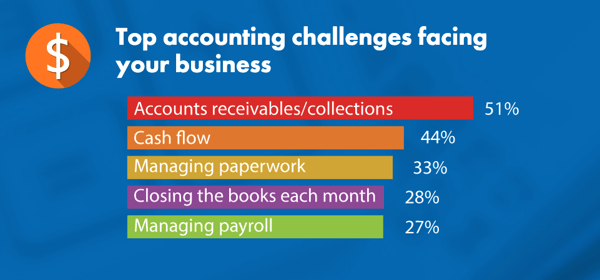

Did you know that 28 percent of small business owners struggle with closing the books every month?

Here's a secret — you don’t need to be an accounting whiz to get your bookkeeping right. We'll go over how to do your own bookkeeping as a small business, along with some resources that will boost your confidence.

The Benefits of DIY Bookkeeping

Why should you handle the books yourself? DIY bookkeeping saves costs and provides an accurate understanding of your company’s financial wellness. Here are some of the benefits of doing it yourself vs. using a bookkeeper:

- Reduced stress come tax season

- You'll have the power to make better business decisions, plan strategy and stay in control of your money

- Saved expense of hiring a bookkeeper or accountant

- You'll keep a pulse on the financial workings of your business

- Your company's financial info will stay private

- Ability to choose your own accounting process and software

How to Do Your Own Bookkeeping

If you're wondering, "Can I do my own bookkeeping?" the answer is yes. Doing your own bookkeeping for your ecommerce business can be done if you're willing to understand the important steps needed to accurately track your financial transactions.

1. Open a Separate Bank Account

Set aside a dedicated business checking and savings account so you’re never mixing personal with business. It’s a common bookkeeping mistake that you want to steer clear of. Ask these important questions before finalizing your bank account.

2. Track and Categorize ALL Income and Expenses

Get into the practice of recording all the sales, expenses, cash and bank transactions in a general ledger. Start by recording entries as income/revenue and expenses.

If your business has multiple transactions or has revenue above $5 million, then categorize each transaction into the following accounts: assets, income, expenses, liability, and equity.

Pro tip: With an ecommerce business, you might not have utility or storefront fees, but there are merchant, shipment, return processing and payment gateway fees that require your special attention.

3. Decide on Single or Double Entry Method

This is one of the first things you need to finalize for accurate bookkeeping. The single-entry method records only one entry per transaction, like a cash register.

In the double-entry method, each transaction is made to two accounts. For every credit entry, there would be a corresponding debit entry to another account.

4. Stick to a Schedule

DIY bookkeeping is easiest if you follow a schedule. Make a list of activities that you need to reconcile regularly. We have provided a sample task list that can help you stay up-to-date.

|

Weekly

|

Monthly

|

Quarterly

|

Yearly

|

|

Enter, categorize and reconcile transactions

Scan receipts

Track customer returns/refund processing

|

Pay bills, vendors and merchant fees

Count inventory across platforms

Review payroll and sales

|

Report state and local sales tax

Estimate quarterly taxes

|

File income and payroll taxes

Record annual value of inventory

Write off any asset depreciation

|

5. Know the Important Financial Statements

Your company’s finances tell the truth about your business’s health. It’s vital to know which important financial statements you need to create and track.

6. Invest in an Online Bookkeeping Tool

Only 50 percent of small businesses use accounting and bookkeeping tools to their advantage. Online bookkeeping software can boost your efficiency, reduce errors, save money and let you focus on aspects that you enjoy.

Pro tip: Lookout for solutions that have inventory tracking and sync seamlessly with your ecommerce platform.

Top Small Business Bookkeeping Tools

We've rounded up some of the most affordable and user-friendly tools that will make you a bookkeeping master and relieve you of number crunching. The majority of these solutions are cloud-based (you can access them from anywhere) and offer free trials.

Wave is touted as one of the most user-friendly bookkeeping tools for small businesses. Its easy-to-read dashboard and affordability (it’s completely free!) make it a top choice for solopreneurs. The software offers unlimited invoicing, receipt tracking, bank reconciliations and can integrate with Paypal, Etsy, FreshBooks, and QuickBooks.

Is QuickBooks good for ecommerce? Well, over 3.3 million small businesses in the U.S. use this software that manages expense tracking, billing, invoicing, inventory tracking and reporting. With packages from $25/month, QuickBooks Online is best for small businesses on a budget. It has a powerful interface that ties with Etsy, Shopify and Amazon.

Kashoo's accounting software suits any type of small business, even if you just set up shop yesterday. The TrulySmall solution offers real-time reconciliation and reporting, automatic categorization and invoicing. The app’s Smart Inbox centralizes your workflow and highlights transactions needing your attention. Kashoo’s low price point of $20/month for unlimited users makes it stand out.

FreshBooks hasn’t become one of the most recognizable names in the small business world for no reason. Owners love FreshBooks for its straightforward dashboard, mobile interface and detailed guides. The platform has plans which start as low as $7.50/month.

Zoho Books' ecommerce bookkeeping software includes inventory management, banking, and financial tracking tools. The software integrates with leading payment gateways like Stripe, PayPal, and Forte; plans start at $15/month.

Xero’s top feature is its powerful mobile interface. You can accept payments, create invoices and purchase orders, track inventory and view statements on the go. The tool allows an unlimited number of users; plans are as low as $11/month.

OneUp, used by 700,000 users, is an all-in-one tool priced at $9/month for one user. OneUp automates and streamlines your bookkeeping; the program “learns” your accounting and can accurately reconcile bank transactions with invoices (woah!).

Bookkeeping Keeps Your Business Running Smoothly

Accurate bookkeeping practices lead to better, more informed financial decisions. Using the recommended bookkeeping tools will keep your ecommerce business running like Usain Bolt.

Need some additional help for your ecommerce business? Check out our DIY course for starting your business. We'll guide you through each step of forming your own business.