A side hustle is a great way to dip your toe into the waters of entrepreneurship. And you'd be in good company, as nearly 7 out of 10 Americans have a side hustle.

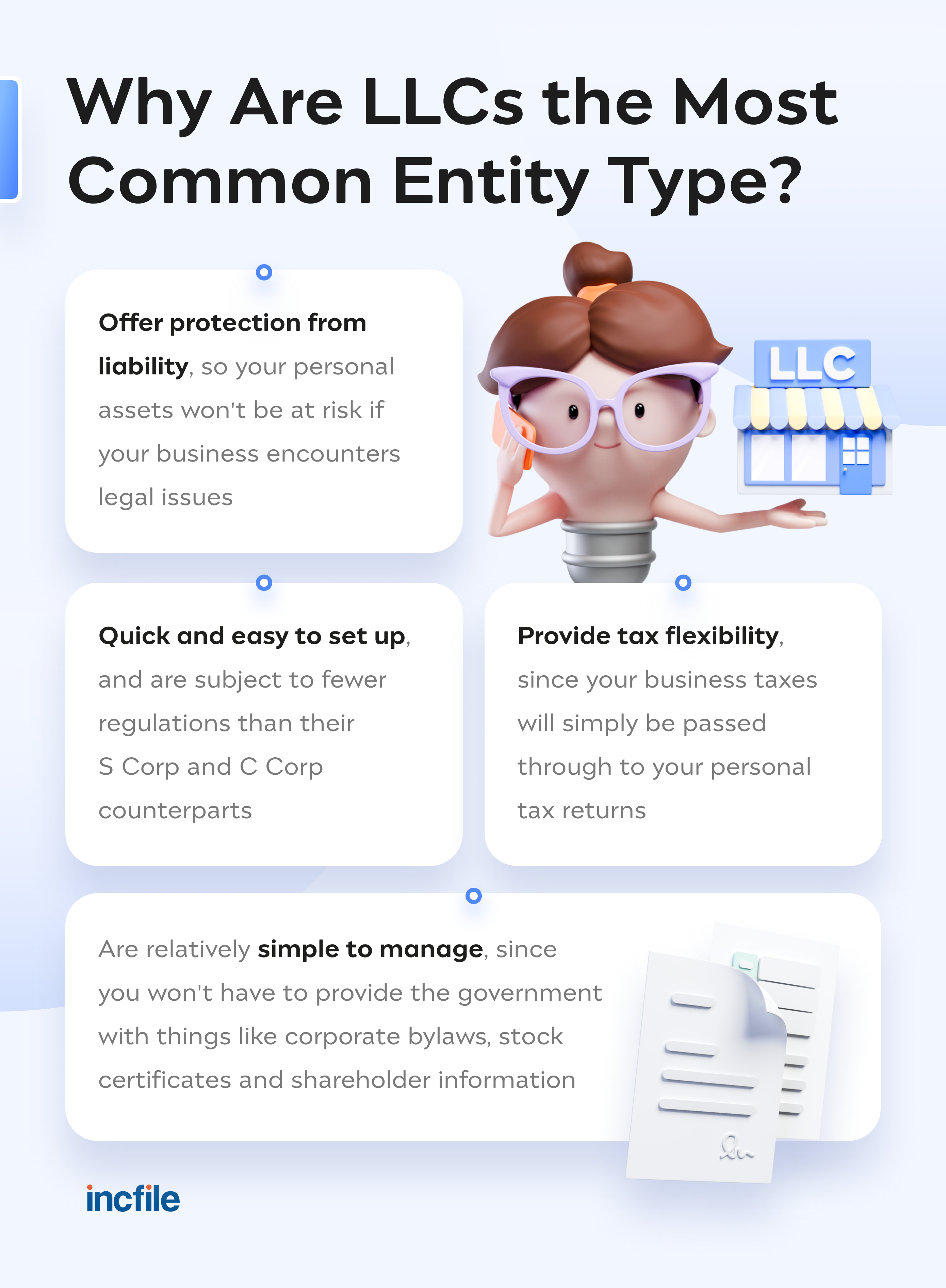

If you feel that you really want to boost your income and turn your hustle into a more serious venture, then forming an LLC can be a great idea. The question is, at what point do you need an LLC for your side hustle? To answer that, we’ll break down the main benefits that a Limited Liability Company provides to help you decide if it’s right for you.

Let’s get into it.

An LLC Can Protect Your Personal Assets From Liability

When you form an LLC, it’s considered to be a “separate legal entity.” That means it has its own assets, bank account, debts and liabilities. Most importantly, all of those areas are considered to be separate from you personally. This means if another business or individual has an issue with your side hustle, then any action they take will be against the LLC and not you and your personal assets.

You will need to follow some rules to maintain this liability protection for your side hustle. Your LLC will need its own business bank account, and your LLC, rather than you personally, should be a party to any contracts you sign.

This separation of liability can give you tremendous peace of mind when carrying out your side hustle.

An LLC Can Build Credibility and Trust in Your Side Hustle

Whether you want to set your side hustle apart from others or you want to transform it into your main source of income, it’s vital to build trust and credibility with clients and customers. An LLC can help you achieve that. Because it requires effort to create and maintain an LLC, the fact you’ve put the work in tells others that you take it seriously.

An LLC can also be very helpful for negotiating with other businesses. Many banks will require you to have an LLC before you can open a bank account. Suppliers and business partners may also prefer to deal with an LLC because it means everything is a little clearer.

If you want to scale up your side hustle to a full-time income, then the extra credibility from being an LLC can boost your competitive advantage.

An LLC Is Fast, Simple and Inexpensive to Create and Run

You want to focus on running and growing your side hustle business, not figuring out share options, ownership structures or EBITDA! An LLC provides the perfect balance between owning a business and not having to spend too much time or effort on administering it.

You can pull together all of the information you need to file an LLC and make your application online in just a couple of hours. Once that’s done, your Secretary of State will form your LLC and you’ll have your shiny new business in as little as a day, with an expedited service.

Meeting the formal requirements of running your LLC is easy as well. You may need to file an annual report every year or two, and we can help you take care of that. From a tax situation, the bookkeeping and accounting for most LLCs will be almost identical to if you’re a sole proprietor.

Enjoy fast and effortless $0 LLC formation when you file your LLC through Incfile.

An LLC Gives You Flexible Ways to Own a Business and Distribute Side Hustle Profits

Your side hustle has taken off, and it's time to bring in new business owners. Whether you’re taking on partners or deciding the best way to split your profits, an LLC makes the whole process much easier.

You can use an operating agreement to manage the rules of your LLC — how you structure ownership, what everyone’s share of the profits will be and how you make important business decisions. An LLC also broadens your options for business ownership, as people don’t need to be citizens or residents of the U.S. to be owners.

If the day comes when you want to sell your business, that’s much easier to do if it’s all contained within an LLC. You can transfer ownership rights to someone else, with less hassle than if you were a sole proprietor or partnership.

Your LLC makes business ownership easy.

An LLC Helps You to Protect Your Privacy and Side Hustle Brand as You Scale

As your side hustle grows, you may want to move away from putting your own name on everything and create a brand that resonates with your audience. An LLC can help you do that. You can name your new business so it’s appropriate for your side hustle, or use a DBA to create a trading name.

LLCs help in other ways, too, by protecting your personal information. You can apply for an Employer Identification Number (EIN) and use that in place of your SSN on official forms and documents. You can then use your EIN when filing for certain types of taxes. You can even set up a virtual office and get your mail wherever you are in the world.

An LLC makes it easy to protect yourself and grow your brand.

An LLC Could Provide You with Some Big Tax Benefits

Finally, your LLC can reduce your tax burden. If your side hustle is earning a good amount of money, you might consider forming an LLC but filing taxes as an S Corporation. This lets you reduce your self-employment tax by paying yourself through a combination of a salary and distributions.

This can get a little bit complicated, but if you’re prepared to put the work in, you could reduce your taxes by a few thousand dollars a year.

So, at what point do you need an LLC? We'd suggest that if your side hustle is really taking off, then the best time is right now. Take advantage of Incfile’s $0 LLC formation, and start the next step in your business journey today.