As a solopreneur, you don't need to worry about the same set of issues that traditional entrepreneurs do. You don't have a partner, you don't have W-2 employees and you don't have a team to whom you can delegate tasks.

So, you'd be wise to wonder which Incfile add-ons are relevant to your solopreneur business and not geared toward larger companies. To help you get your one-person business running like a well-oiled machine, we've gathered the best Incfile add-ons for you.

Here's how you can create an Incfile package that's perfectly tailored to the needs of your solopreneur business.

What Is a Solo Entrepreneur?

First thing's first: What is a solo entrepreneur?

Often referred to as a "solopreneur" for short, a solo entrepreneur is simply an entrepreneur who doesn't have a business partner or employees.

In other words, a solopreneur is the lone wolf of the business world. They run their own business entirely by themselves, and their ultimate goal isn't to grow their team or distribute their workload.

It's to do all the work themselves, be as self-sufficient as possible and reap the rewards as a result.

If you're starting your own solopreneur business and want to make it as efficient and effective as possible, Incfile has a number of add-ons that can help.

Ahead, we'll explain how you can use Incfile's solopreneur business tools to take your one-person company to the next level.

How to Choose the Best Incfile Add-ons for Your Solopreneur Business

Ready to create a custom-built Incfile package that's perfect for your solopreneur business? These are the steps you'll need to take.

Choose the Right Entity

Before you can decide which add-ons to purchase, you'll need to determine which business entity is right for you.

Long story short, if you want to run a for-profit business, then you can choose between a Limited Liability Company (LLC), S Corporation and C Corporation.

But as a solopreneur with no employees, then you'll likely find that an LLC is the best entity type for you.

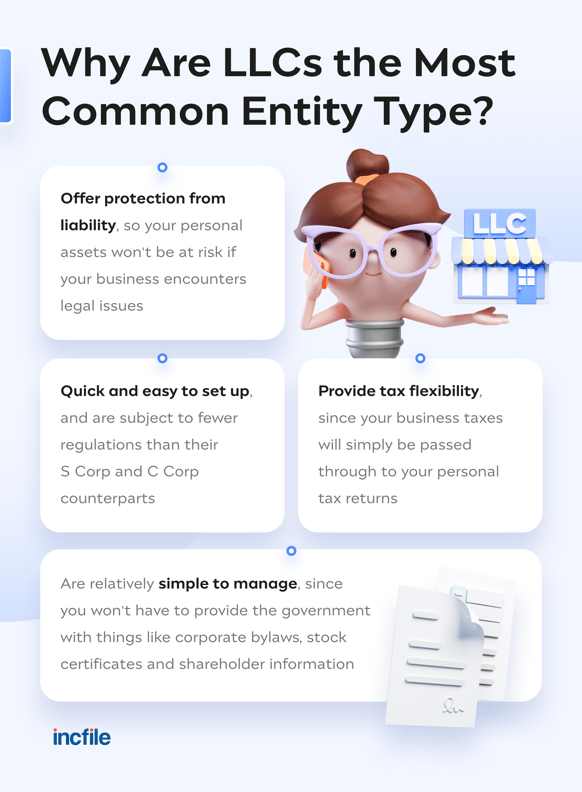

LLCs are the most common entity type for new and small businesses for several reasons.

So while you should certainly research each entity type before making a final decision, we can confidently say that most solopreneurs benefit from forming an LLC over other types of business structures.

So while you should certainly research each entity type before making a final decision, we can confidently say that most solopreneurs benefit from forming an LLC over other types of business structures.

Select an Incfile Package

The next step of the process is to decide which type of Incfile package is right for you: Silver, Gold or Platinum.

You'll be glad to know that we take the guesswork out of filing for a business entity, so you can't go wrong with any of our packages if you're starting a new small business.

Everything you need to complete the complex process of filing your entity with your state's government comes with every Incfile package. Starting at just $0 plus state fees, every package includes the following:

- Preparing and filing your Articles of Organization.

- Unlimited name searches so you can ensure your business' name is original.

- One full year of 100 percent free Registered Agent service, so you can stay on top of important paperwork

And no matter what package you choose, we'll also provide you with a free tax consultation, order status tracking, next-business-day processing, lifetime company alerts to remind you of upcoming filing requirements and online access to your documents.

Pick Out Awesome Add-Ons

Now it's time for the fun part: picking out Incfile add-ons that can make your life easier and help your solopreneur business run even smoother.

We know that funds are probably tight as you work on getting your new company off the ground, so we created some useful add-on options that are completely up to you. These add-ons let you customize any package according to your business needs.

Articles of Amendment

Things change, and as the sole owner and employee of your business, you have the power to change them.

But if you want to change something like your company's name, the services you offer or the address you're located at, you'll need to notify your state by filing Articles of Amendment.

Incfile's Articles of Amendment filing service costs $99 plus state fees, and it's a necessary investment when you need to make a formal change.

Virtual Address

As a solopreneur, you want to operate your business from a location that makes the most financial sense, but you also don't have a fleet of employees you can task with mail retrieval.

That's where Incfile's Virtual Address service comes in. You get a fixed street address, and we'll securely scan and upload your business's mail for just $29 a month.

Employer Identification Number (EIN)

You won't just need an EIN for hiring employees — you'll also need one if you want to open a business banking account or need to file certain types of tax returns. (Not sure if you need an EIN? Check the IRS' list of qualifications to find out.)

If your solopreneur business needs an EIN of its own, Incfile's EIN service can help you get one quickly for just $70. The biggest benefit here is that everything is taken care of for you, so you won't spend time setting up an account with the IRS website and inputting all your information. Also, your EIN will be stored securely in your Incfile dashboard, so you never have to go hunting for printed information.

Trademark Registration

Want to make sure that none of your competitors can use your business's name or logo? Then you'll need to register your trademark with the U.S. Patent and Trademark Office (USPTO).

That's no easy task, though, and there are plenty of pitfalls along the way. Fortunately, Incfile's Trademark Registration service makes the process a breeze, and it costs just $199 plus the federal filing fee (we even include professional legal counsel).

Business Contract and Document Templates

Just because you don't have employees doesn't mean you won't want to work with contractors to expand and improve your business's offerings. But working with contractors means you'll need to protect yourself and your business with the proper legal documents.

That's where Incfile's library of contract and document templates comes in. It's only $150 if you have our Silver or Gold package, and it comes with the Platinum package at no additional cost.

It includes templates for documents such as:

- Independent contractor agreements

- Collaboration agreements

- Consulting agreements

- Non-disclosure agreements

- Banking resolutions

- Terms of service

- Privacy policies

- Cease and desist letters

- Bills of sale

Business License or Permit

Depending on the types of products and services you offer, you might need a special business license or permit to legally run your solopreneur business.

For example, you might need a general contractor's license, a seller's permit or an occupation-specific license.

Determining which types of licenses and permits you need isn't a simple task, though, especially when you consider that many states don't have a statewide general business license. Instead, you'll likely need to go through your city or county government.

The good news is that Incfile's Business License Search Tool can make your life a whole lot easier. Simply enter your state of formation and industry, and we'll tell you which licenses and permits you might need.

"Doing Business As" (DBA)

If you want your company to do business under a name that's different than the one you filed your LLC under, then you'll need to create a "Doing Business As" name, or DBA for short.

For instance, you may want to use a different name to sell different products, or you may want to operate in a different city under a location-specific name.

Whatever the case, a DBA can make it happen, and Incfile's DBA filing service can make the process of getting a DBA a snap.

Certificate of Good Standing

When you need to prove that your business is in compliance with all the regulations it needs to be, a Certificate of Good Standing can help. (Depending on where you live, it might be called a Certificate of Existence, Status or Authorization instead.)

You might find yourself needing a Certificate of Good Standing when attempting to get a business loan, operate your solopreneur business in a different state or set up a business credit card.

While you can apply to get one yourself, using Incfile's Certificate of Good Standing service will save you time and paperwork.

Change of Registered Agent

Should you ever want to change Registered Agents, you'll need to notify your state using the appropriate avenue.

If you'd rather focus on running your solopreneur business than hunting down the right forms and navigating your state government's website, you'll love Incfile's Change of Agent service. Pay $49 plus your state fee and we'll handle all the paperwork for you.

Business Reinstatement

Being a solopreneur is immensely rewarding, but going it alone can also mean it's more difficult to stay on top of administrative duties and mandatory due dates.

For instance, let's say you're busy running your business, and you don't have Incfile's Virtual Address service. So when your Secretary of State sends you a letter saying your annual report is overdue, it falls through the cracks.

In such a scenario, your LLC could be dissolved by the state. In order to legally open it again, you'd need to get it reinstated.

With Incfile's Reinstatement service, you can get your solopreneur business back in good standing in no time.

Business Accounting and Bookkeeping

Running your business by yourself, you won't be able to delegate all your accounting and bookkeeping tasks to an internal team of finance experts.

Instead, you'll need to balance your books and file your taxes yourself. Unless you're a tax aficionado, that could mean hours spent filling out forms and double-checking your calculations.

If that sounds like something you want to avoid, Incfile's Accounting and Bookkeeping service will be right up your alley.

Use Incfile Add-ons to Upgrade Your Solopreneur Business

Solo entrepreneurs shouldn't have to choose between wasting their time or their money. That's why Incfile's add-ons are designed to make it easy for solopreneurs to create a unique business services package that take the guesswork out of running a business, all without breaking the bank.

Want to stay posted on more ways you can grow and maintain your solopreneur business? Subscribe to the Incfile blog — we publish multiple articles each week to keep you updated on all things small business.