It's true — business owners need to keep up-to-date on their annual reports, no matter how sunny the weather or fabulous the beaches. So if you're incorporating a business, such as an LLC, S Corp, C Corp or a nonprofit registered in the state of Florida, then you will have to file a Florida annual report every year.

Many entrepreneurs choose to base their businesses in Florida, not only because of the beautiful year-round weather but also because of the lower tax burden and pro-business climate. Did you know that the Sunshine State is home to 2.8 million small businesses? In fact, small businesses make up 99.8 percent of businesses in Florida and employ more than 40 percent of the state’s private-sector workforce, according to Business News Daily. That's a lot of Florida annual reports that need to be submitted.

We’ve compiled the most important information you’ll need to make sure you submit your Florida annual report on time to keep your business up to date with the state of Florida and eligible to do business there. Read on to learn everything you ever needed to know about how to file an annual report in Florida.

How Do I Submit an Annual Report in Florida?

Filing your annual report in the state of Florida must be done completely online via the Florida Department of State’s secure online system. You can send your payment by check or money order in the mail or pay online.

Before you start, make sure you have all of the necessary information at your fingertips and are prepared to pay the associated fees. Read on to know exactly what you need to include in your Annual Report for the state of Florida, how much it will cost and when you need to have it completed by.

Information Needed to File a Florida Annual Report

In Florida, you will need to include the following information in your annual report:

- Your document number: This is the 6- or 12-digit number assigned to your entity by the state when the business entity was registered. If you forget it, you can look it up on the Florida Department of State’s records. Refer to your notice or search state records by name.

- Your business name: Note: If you’ve changed your business name over the past year, you’ll need to file an amendment form with the state first.

- Business address: This is the street address of your business’s primary location.

- Mailing address: Include it if it differs from your business address.

- Your Registered Agent’s name, address and signature: You must have a Registered Agent in the state of Florida. If you’ve changed your Registered Agent, this is the time for you to let the state know who your new agent is.

- Principals’ names and addresses

- Your signature: You and your Registered Agent can sign this document electronically by typing your names into a box on the online application.

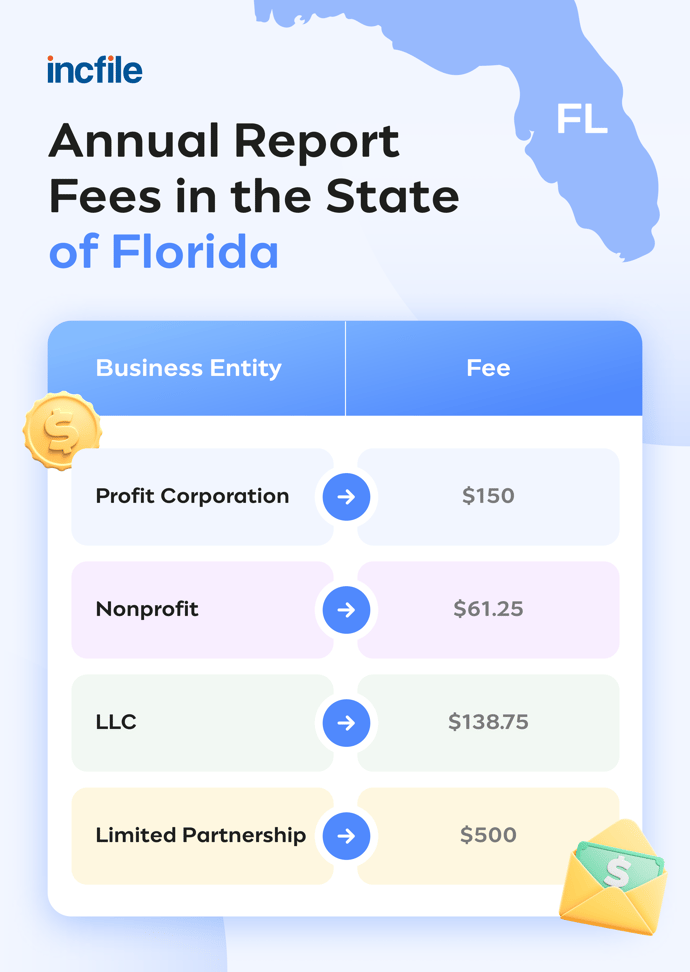

How Much Does It Cost to File an Annual Report in Florida?

Each business entity will pay a different fee for their annual report in the state of Florida. For example, an LLC annual report pays $138.75 while a nonprofit corporation pays $61.35.

You have a few options for paying this fee, including online payments, check or even money order. If you pay by check, make the check out to the Florida Department of State. Considering the fact that the late fee in the state of Florida is $400, it’s important to file promptly by May 1.

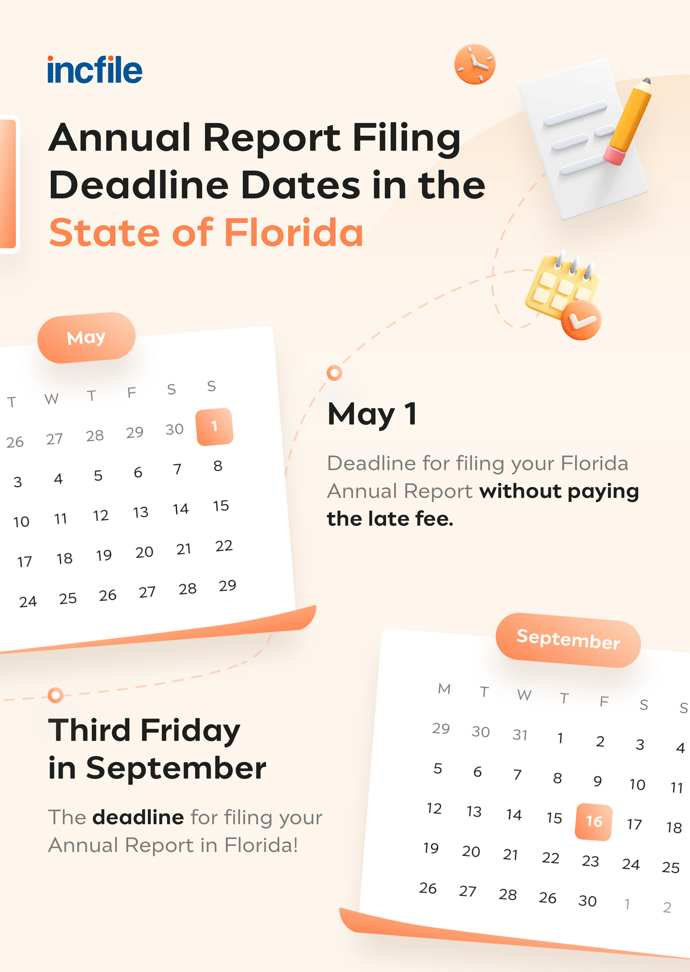

What Are the Filing Deadlines for Annual Reports in Florida?

The price for filing late is steep at $400, but if you don’t file at all, your penalties are even higher. In Florida, you will need to follow the state's specific filing deadlines to avoid costly mistakes. This means filing your annual report every year by May 1. (The state will not charge a late fee for nonprofits that file after May 1.)

After that, you have until the third Friday of September to file your annual report (with the late fee) in order to remain an active business entity. If you miss the third Friday of September deadline, then your business will be dissolved and your entity revoked.

If you miss the September deadline and your LLC, corporation or limited partnership was dissolved by the state, you can apply for reinstatement online. Of course, it will take time to become fully reinstated and you will pay fees associated with the process.

Changes You Can Make in Your Florida Annual Report

When you file your annual report in Florida, it is an opportunity to notify the state of important changes you have made over the past year. Some changes, such as your business name, will require additional forms to be filed with the state.

You can change the following things in your Annual Report:

- Add, delete or change names of principals and partners

- Change your Registered Agent

- Change your business address or mailing address

- Change your EIN

Now you know everything you will need to do in order to submit your Florida annual report on time and ensure your business remains compliant with the state. Bookmark the Florida Department of State website and enter the deadlines in your calendar.

Even better, let Incfile take care of these details for you. We offer the full-service Annual Report Filing service for your LLC or business entity, which includes facilitating the filing of your annual report, keeping track of deadlines and making sure nothing falls through the cracks. This frees you up to focus on what matters most, like running and growing your business.