Millions of shoppers are visiting ecommerce business sites every day and the number of online shoppers is growing.

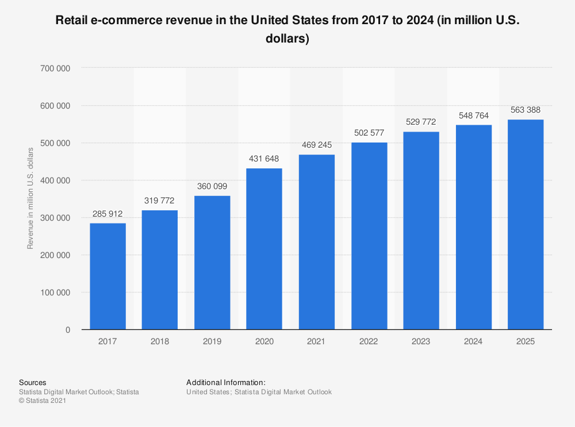

According to Statista, there were 209 million people in the United States visiting and buying from online businesses. That number is expected to increase, with 2021 projected to reach 230 million ecommerce shoppers. Revenue from ecommerce is also in an upward trajectory moving from $431 billion in 2020 to a projected $563 billion by 2025. As a result of these growing opportunities, new businesses are forming as ecommerce businesses in an effort to gain from this online shopping trend.

But like brick-and-mortar businesses, will your ecommerce business require a Registered Agent? And if so, how can you go about finding the right Registered Agent without having a physical address? Luckily we have done all the research and can help provide you with the answers you are looking for.

Does an Online Business Need to Be Registered?

Whether your business formation is an LLC, S Corp, partnership or corporation, it is important that it is registered within the state or states where you are doing business. Being compliant with the rules and regulations within your state or states of operation will ensure that your business is in good standing and will help avoid costly fines, penalties and even worse — dissolution of your business entity.

One key requirement for registering your business is appointing a dedicated Registered Agent. The role of the Registered Agent is to receive important documents and correspondence and pass these on to you. Mailings received by an agent can include state and federal documents, tax notices and requests to complete company filings and reports, as well as legal process notification such as subpoenas, summonses and lawsuits.

The only exception where a Registered Agent is not required is if you are an unincorporated business, such as a sole proprietor or partnership. However, choosing not to file as a legal entity is not recommended. Being an unincorporated business does not offer the protections of an LLC and can hold a business responsible for greater risks and unlimited liability. It also can also put your personal finances at risk and make you liable for legal actions.

Is a Registered Agent Necessary?

Whether or not you’re an online business, every state requires that your business has an appointed Registered Agent to represent your company and receive your important correspondence. And for your business to run smoothly and stay compliant with state and federal regulations, your agent must meet the demands of the job and ensure that you are informed and provided with all the vital documents that come in. As a business owner, it is important to pick a reputable individual or service to act as your Registered Agent for your online business. The documents that will come to your agent may be time-sensitive and require action. You’ll also want to make sure that your agent is reputable, especially since they will be handling files with sensitive information that need to be secured.

Having a dedicated agent receive and process these documents helps ensure that they are not overlooked by a busy business owner. They also provide convenience and reliability. If you do not feel comfortable with the notion of hiring a Registered Agent to handle your important correspondence and would feel better by taking on this task yourself, then think again. Being your own Registered Agent may prove to be more trouble than it's worth. Why?

- You may not have the availability to stay in one place from 9:00 a.m.–5:00 p.m. to accept deliveries.

- You may not want to use your address and risk your privacy.

- You might miss important correspondence that may affect the standing of your business.

- The increased paperwork and responsibility are not worth the cost, which could be covered for $100–$200 a year.

- You already have too much on your plate and risk losing focus on your online business.

- You can only do business in the state where you are located.

How Do I Get a Registered Agent without a Physical Business Address?

Many choose to follow an online business model for the freedom it provides them. They can work wherever and whenever they like. They can even follow a digital nomad lifestyle. Now we’ve already established that your online business will need a Registered Agent. It’s also been made clear that one of the key requirements for having a Registered Agent is using a physical location — whether it's your own or your agent's — as your registered business address. So if you operate an online business without a physical location, where will your Registered Agent work? Luckily, you don't need to purchase or rent an office space.

This is where a Registered Agent service comes in. A Registered Agent service will handle all Registered Agent duties for you, including:

- Providing a physical business address

- Accepting any correspondence and mail on your business's behalf

- Digitally uploading or forwarding legal correspondence to you

- Maintaining your business paperwork and keeping tabs on important business compliance due dates, like taxes and annual reports

Don't forget that you still need a legal business address for your online company, even without a physical headquarters. This designates where your business runs from. While you can use your Registered Agent's address or your home address as your business address, another option favored by business owners running ecommerce sites is to use a virtual office address.

Having a virtual address — also referred to as digital mail or virtual mailbox — provides you with a credible physical address owned by a service provider. But rather than retrieving your mail from that address, all of your correspondence is digitized and sent securely to you. This provides business owners with convenience, flexibility and a means to access their important correspondence online.

Having a virtual mailbox also ensures privacy and security. It will create a separation between your home and home-based business. NOTE: While a virtual address is ideal for an online business, it cannot be used as your Registered Agent's address, as they need to be located at a physical address.

Finding a Registered Agent for Your Online Business

If you're ready to register your business, Incfile offers a free Registered Agent service for one full year if you start your business with us. This service provides clients with one easy-to-navigate digital dashboard with access to all time-sensitive and important documents and filing information.

Ready for more info? Our free "Find Your Next Registered Agent" guide will give you all the tips and tricks for finding a Registered Agent for your business.